newartmart.online Categories

Categories

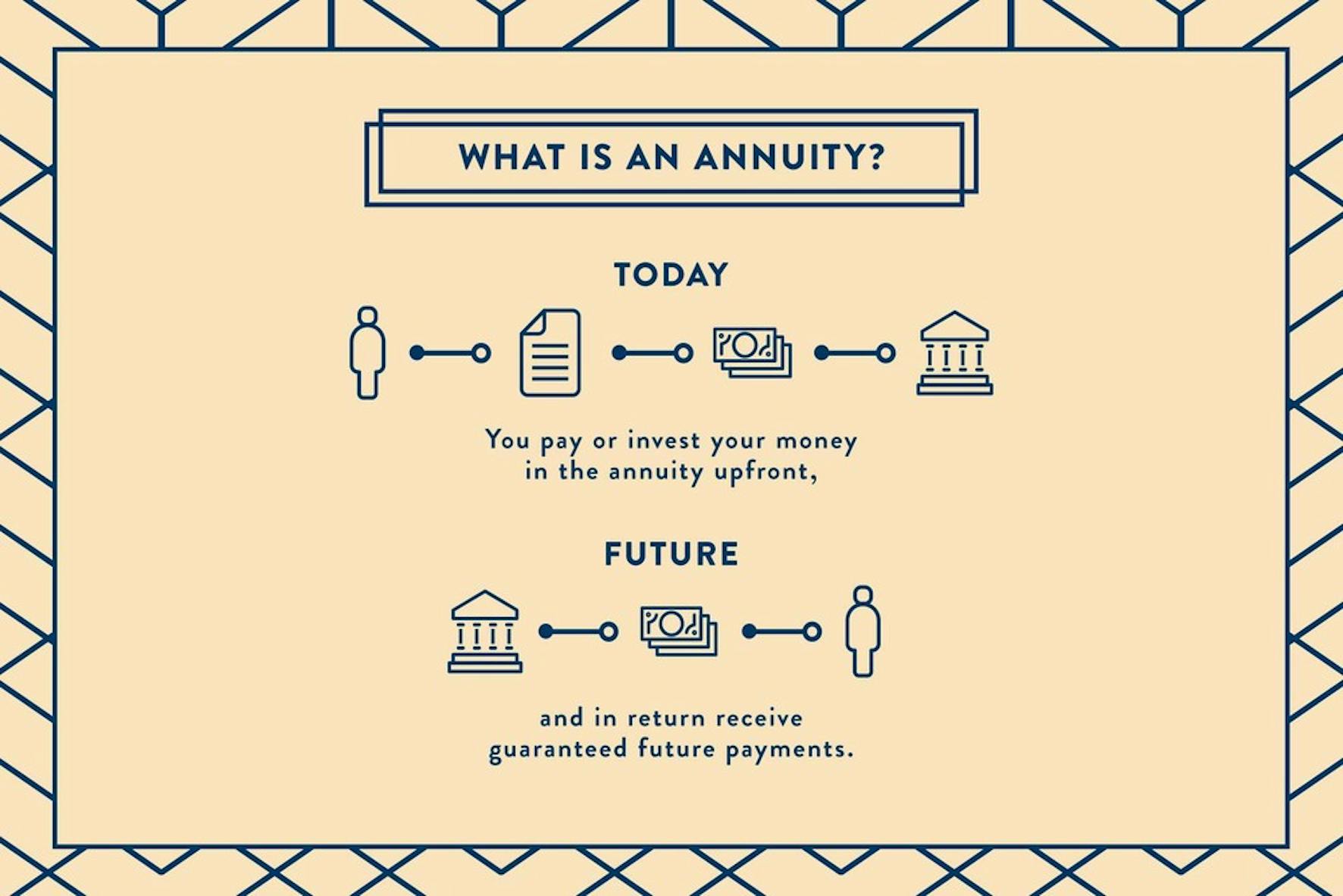

What Are Annuities For

Annuities are investments issued by insurance companies that can be used to help build a guaranteed income stream or a retirement nest egg. It's like being. Annuities are a common source of retirement income because they can provide a steady stream of payments at regular intervals and because their earnings grow. Annuities are a popular choice for those seeking certainty and predictable income streams in retirement; however, they can also be complex and confusing. An annuity requires the issuer to pay out a fixed or variable income stream to the purchaser, beginning either at once or at some time in the future. An annuity is a contract between an individual and an insurance company. The investor contributes a sum of money—either all up-front or in payments over time. Once you've bought an annuity, it's a very stable way of funding your retirement. They're one of the few ways you can get a guaranteed retirement income for the. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Trusted annuity provider · A fixed or increasing income · Payment options · Guaranteed minimum payment period · Choose to protect all or part of the amount used. An annuity is a contract between an individual and an insurance company. The investor contributes a sum of money—either all up-front or in payments over time. Annuities are investments issued by insurance companies that can be used to help build a guaranteed income stream or a retirement nest egg. It's like being. Annuities are a common source of retirement income because they can provide a steady stream of payments at regular intervals and because their earnings grow. Annuities are a popular choice for those seeking certainty and predictable income streams in retirement; however, they can also be complex and confusing. An annuity requires the issuer to pay out a fixed or variable income stream to the purchaser, beginning either at once or at some time in the future. An annuity is a contract between an individual and an insurance company. The investor contributes a sum of money—either all up-front or in payments over time. Once you've bought an annuity, it's a very stable way of funding your retirement. They're one of the few ways you can get a guaranteed retirement income for the. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Trusted annuity provider · A fixed or increasing income · Payment options · Guaranteed minimum payment period · Choose to protect all or part of the amount used. An annuity is a contract between an individual and an insurance company. The investor contributes a sum of money—either all up-front or in payments over time.

An annuity is a financial contract that offers a stream of income, often in retirement, in exchange for money paid into the annuity. Annuities are a popular. Then, after you retire, you receive annuity payments each month for the rest of your life. The TSP part of FERS is an account that your agency automatically. Fixed annuities trade present-day payments for guaranteed minimum payouts in the future. They can be a great option for investors looking to supplement their. Annuities are a popular choice for those seeking certainty and predictable income streams in retirement; however, they can also be complex and confusing. Fixed annuities trade present-day payments for guaranteed minimum payouts in the future. They can be a great option for investors looking to supplement their. An income annuity lets you convert part of your retirement savings into a stream of guaranteed lifetime income payments. National Life Group offers life insurance, annuity and investment products to help individuals, families and businesses pursue their financial goals. The investment options for a variable annuity are typi- cally mutual funds that invest in stocks, bonds, money market instruments, or some combination of the. What are annuities? Annuities are insurance products that give you reliable retirement income. Read on to learn how they work. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New. An income annuity lets you convert part of your retirement savings into a stream of guaranteed lifetime income payments. Annuities from Fidelity can help you prepare for retirement by increasing and protecting your savings. See all annuities offered through Fidelity here. In investment, an annuity is a series of payments made at equal intervals. Examples of annuities are regular deposits to a savings account, monthly home. A (b) plan (tax-sheltered annuity plan or TSA) is a retirement plan offered by public schools and certain charities. It's similar to a (k) plan maintained. Delaware Life's top rated Fixed, Fixed Index, & Variable Annuities offer protection, tax-deferred growth & lifetime income so you can retire with. A lifetime annuity as investment vehicle that functions as a personal pension plan. Sometimes referred to as “single life,” “straight life,” or “non-refund,”. Benefit Plan annuities, effective December 1, Retirees saw the change Benefit Plan Annuity. We have a Form Wizard to help fill out the form. An annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. An IRA is a savings account that offers tax advantages, while an annuity is an insurance product. Read on to understand the difference. Treaty annuity payments are paid annually on a national basis to registered Indians who are entitled to treaty annuities through membership to bands that.