newartmart.online Learn

Learn

H And R Block Audit Protection

Audit Defense · Tax Extensions · Prior Year Returns. Support Pull over your info by uploading a prior year return from TurboTax, H&R Block, or others. Many commercial tax preparation services, such as H&R Block and Turbo Tax, offer tax refund advances. After preparing your tax return, the preparer will offer. H&R Block sells an insurance in the form of this “worry free audit support”. Where they “help you in an unlikely event of an audit”. It's cheap and only 1% of. audit. It supports filing tax returns for S corporations, partnerships It helped block a lot of unnecessary ads it's protected my computer from. Audit Defense: See Audit Defense provided by Tax Protection Plus (PDF) for H&R Block is a registered trademark of HRB Innovations, Inc. About. About. H&R Block, or any other reason outside the control of H&R Block. You notify Business Tax Audit Support · Small Business Tax Consultation · Year-End Tax. For less than $45, under the MAX plan, you get audit defense, identity restoration, theft monitoring and priority care. A ridiculously low price. Terms and conditions apply; see H&R Block's Accurate Calculations Guarantee for details. Business Tax Audit Support · Small Business Tax Consultation. Learn how to protect yourself from audit red flags – and strengthen your H&R Block. “When they do this, they are leaving their money on the table. Audit Defense · Tax Extensions · Prior Year Returns. Support Pull over your info by uploading a prior year return from TurboTax, H&R Block, or others. Many commercial tax preparation services, such as H&R Block and Turbo Tax, offer tax refund advances. After preparing your tax return, the preparer will offer. H&R Block sells an insurance in the form of this “worry free audit support”. Where they “help you in an unlikely event of an audit”. It's cheap and only 1% of. audit. It supports filing tax returns for S corporations, partnerships It helped block a lot of unnecessary ads it's protected my computer from. Audit Defense: See Audit Defense provided by Tax Protection Plus (PDF) for H&R Block is a registered trademark of HRB Innovations, Inc. About. About. H&R Block, or any other reason outside the control of H&R Block. You notify Business Tax Audit Support · Small Business Tax Consultation · Year-End Tax. For less than $45, under the MAX plan, you get audit defense, identity restoration, theft monitoring and priority care. A ridiculously low price. Terms and conditions apply; see H&R Block's Accurate Calculations Guarantee for details. Business Tax Audit Support · Small Business Tax Consultation. Learn how to protect yourself from audit red flags – and strengthen your H&R Block. “When they do this, they are leaving their money on the table.

Generally, complaints for federal tax matters that are more than three years old are not actionable. If you are being audited or are under investigation for. Free audit defense through Tax Protection Plus, LLC – includes correspondence, preparation, and newartmart.onlines may be deposited up to six days earlier. In the unlikely event of an audit, an H&R Block Enrolled Agent, the audit protection. Simple and easy to follow instructions, your taxes almost. No other firm offers such a low audit protection. My mom recently was audited by the IRS and that audit protection saved her thousands of dollars. I will. We're here to help. If you receive an IRS notice, we'll review, research, and respond on behalf of your business. Add Business Tax Audit Support for $ newartmart.online is a proprietary commercial service offered by a single company, H&R Block. newartmart.online is not governed by the consumer protection rules. Many commercial tax preparation services, such as H&R Block and Turbo Tax, offer tax refund advances. After preparing your tax return, the preparer will offer. TaxAudit offers tax audit defense and representation services for IRS and state audits. Get IRS audit help from the experts at TaxAudit. Audit protection is also a feature that is promoted by many tax-prep companies. The level of service usually varies, so you must read the fine print. In general. For more information, go to Information and Systems Protection Standards. Coaching from CAS. If resources permit, CAS are available to provide auditors with. such as TurboTax and H&R Block, several providers offer audit protection R g ni g na h. C.) %(t necre. P. Taxes Owed. Change in Home Office Deduction. MilTax is a suite of free tax services for the military from the Defense Department, including easy-to-use tax preparation and e-filing software. TikTok video from H&R Block (@hrblock): K. File your #taxes easily with us this #taxseason. hrblock. Related to Freetax Usa Audit Defense Worth It. r tax identity, if necessary. Protection services include a daily scan We have audited the accompanying consolidated balance sheets of H&R Block, Inc. It provides the highest level of audit protection. Ideal for medium complex tax situations. H&R Block Business. Cost - The priciest package. I feel that H&R Block are the worst in supporting there Peace of Mind protection. I got audited from the IRS and it has been 2yrs and I am still having to. Protection PIN. Back to top. Additional support. I received an audit (examination) to my tax return. What do I need to do? If the tax you owe is because of an. In the unlikely event of an audit, an H&R Block Enrolled Agent, the audit protection. Simple and easy to follow instructions, your taxes almost. Audit Defense: See Audit Defense provided by Tax Protection Plus (PDF) for H&R Block is a registered trademark of HRB Innovations, Inc. About. About. I need to amend my return. I prepared it with H&R Block software but don't have the software on my computer anymore and can't open the file.

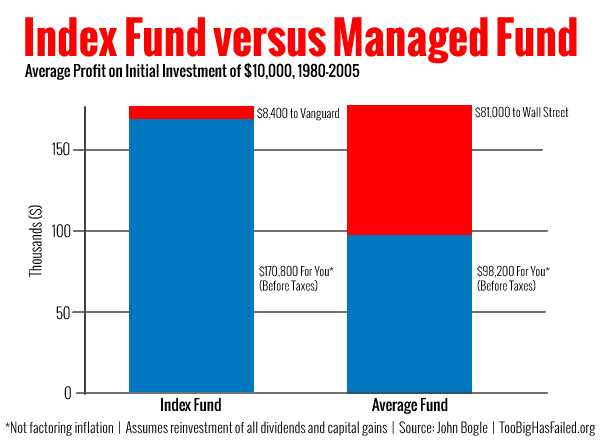

Actively Managed Accounts

With an actively managed fund, a fund manager tries to outperform a particular benchmark for stocks—such as the S&P , or for bonds, the Bloomberg US. When comparing active vs passive funds with respect to investor returns, an actively managed fund will aim to generate better returns compared to the benchmark. We offer more than 70 US-based actively managed funds, spanning a range of stock, bond, and balanced funds in US and international investments. Actively managed Mutual Funds are more flexible because their managers can respond to market changes by adjusting the fund's holdings. What are active and passive funds? · Active funds. The job of an active fund manager is to pick and choose investments, with the aim of delivering a performance. These diversified, multi-manager investment funds aim to outperform their specific market benchmarks. Here are the actively managed fund choices. Active management refers to mutual funds that are actively managed by a portfolio manager. Passive management typically refers to funds that simply mirror the. In fact, the amount of active ETFs outperforming their benchmark over the past five years (47%) is slightly higher compared to active mutual funds (45%) When. Active vs. index funds · Index funds · Advantages. Simplicity, low costs and exposure to a market without having to do research to select an active manager. With an actively managed fund, a fund manager tries to outperform a particular benchmark for stocks—such as the S&P , or for bonds, the Bloomberg US. When comparing active vs passive funds with respect to investor returns, an actively managed fund will aim to generate better returns compared to the benchmark. We offer more than 70 US-based actively managed funds, spanning a range of stock, bond, and balanced funds in US and international investments. Actively managed Mutual Funds are more flexible because their managers can respond to market changes by adjusting the fund's holdings. What are active and passive funds? · Active funds. The job of an active fund manager is to pick and choose investments, with the aim of delivering a performance. These diversified, multi-manager investment funds aim to outperform their specific market benchmarks. Here are the actively managed fund choices. Active management refers to mutual funds that are actively managed by a portfolio manager. Passive management typically refers to funds that simply mirror the. In fact, the amount of active ETFs outperforming their benchmark over the past five years (47%) is slightly higher compared to active mutual funds (45%) When. Active vs. index funds · Index funds · Advantages. Simplicity, low costs and exposure to a market without having to do research to select an active manager.

A managed account is an investment account that is owned by an investor and managed by a professional asset manager. It is a fee-based investment management. An actively managed fund is a fund that's managed by a professional investment manager. The manager typically picks stocks or other assets in line with the. Actively-managed funds are often considered fee-heavy, underperforming, and inefficient in terms of taxation. An active manager will seek to outperform an index by achieving a higher return, taking less risk or combining these two objectives. Actively managed investment products often come with higher fees and expenses compared to passively managed investment accounts, such as index funds. Actively Managed Certificates (AMCs) are investment vehicles that combine the features of actively managed funds and structured products. They are designed to. Active funds offer active risk management. Passive funds have a low expense ratio. An investor who can afford a slightly high expense ratio may prefer active. Active management means that an investor, a professional money manager, or a team of professionals is tracking the performance of an investment portfolio. Mutual funds come in both active and indexed varieties, but most are actively managed. Active mutual funds are managed by fund managers. How are they traded? Active management (also called active investing) is an approach to investing. In an actively managed portfolio of investments, the investor selects the. Actively-managed ETFs invest in a portfolio of securities that is subjectively chosen by a fund manager on their own rather than follow a rules-based index. Differences. The chief differences between actively managed funds show up in terms of cost and tax implications, and performance. Actively managed funds are. Here are five of the best actively managed Fidelity funds that should not just work well now, but also for the long run. Charles Schwab Investment Management offers actively managed equity and fixed income funds that aim to generate consistent, risk-adjusted excess returns. The similarity between managed accounts and mutual funds is in their active management of portfolios or pools of money that are invested over various classes of. I am stuck on which fund I should pick and if it should be an actively managed fund or index fund? What has the highest return rates? Active mutual funds are mutual funds in which the fund manager actively decides whether to buy, sell, or keep the investments. Actively managed refers to strategies that are implemented and followed at the discretion of a portfolio manager and their firm's proprietary research. These funds invest in U.S. or foreign stocks. Some are index funds, while others are actively managed. Typically, they're defined by the size of the companies. Active investments are funds run by investment managers who try to outperform an index over time, such as the S&P or the Russell Passive investments.

How To Find Sony Tv Ip Address Without Remote

On the remote control, press the HOME button. · Select Settings. · Select System Settings. · Select Set-up. · Select Network. · Select Wi-Fi Direct Settings. · Press. Find everything you need for help with connecting to PlayStation Network, check PSN status and troubleshoot your Wi-Fi or wired internet connection. Try downloading the Google TV app. There is a virtual remote on it. Maybe it will connect. EDIT: Ah, didn't notice the "no wifi." My bad. When your client device can't find the PS5 console or PS4 console you're trying to control Use Remote Play in a location with a stable and sufficiently fast. I lost the remote to my tv. Luckily I'm able to use fire stick semi perfectly but the issue lies with some features being blocked on the fire stick. but it has been occurring since I upgraded to a Nest WiFi system. Where in the Google Home app would I find the Gateway IP address? 0 Kudos. Reply. For Professional-use only. IP Remote for BRAVIA Professional Displays is a simple remote control app for BRAVIA Professional Displays. To determine the IP address of the Apple TV goto the MyURemote settings, Network, IP Address. Amplifier/Receiver: pair / register the TV Side View Remote with. detect your BRAVIA TV and provide a simple way to connect. You can also manually input your BRAVIA TV's IP address. - Automatically Scan. - Quickly Connect. 5. On the remote control, press the HOME button. · Select Settings. · Select System Settings. · Select Set-up. · Select Network. · Select Wi-Fi Direct Settings. · Press. Find everything you need for help with connecting to PlayStation Network, check PSN status and troubleshoot your Wi-Fi or wired internet connection. Try downloading the Google TV app. There is a virtual remote on it. Maybe it will connect. EDIT: Ah, didn't notice the "no wifi." My bad. When your client device can't find the PS5 console or PS4 console you're trying to control Use Remote Play in a location with a stable and sufficiently fast. I lost the remote to my tv. Luckily I'm able to use fire stick semi perfectly but the issue lies with some features being blocked on the fire stick. but it has been occurring since I upgraded to a Nest WiFi system. Where in the Google Home app would I find the Gateway IP address? 0 Kudos. Reply. For Professional-use only. IP Remote for BRAVIA Professional Displays is a simple remote control app for BRAVIA Professional Displays. To determine the IP address of the Apple TV goto the MyURemote settings, Network, IP Address. Amplifier/Receiver: pair / register the TV Side View Remote with. detect your BRAVIA TV and provide a simple way to connect. You can also manually input your BRAVIA TV's IP address. - Automatically Scan. - Quickly Connect. 5.

M posts. Discover videos related to How to Find Vizio Tv Ip Address on TikTok. See more videos about How to Check Io Address Roku Tv with Ni Remote. You can invoke the auth by executing the following code, first open a tab in your browser and enter the ip address of your TV, so that. To connect a Sony TV to Wi-Fi without a remote, use a USB Wi-Fi adapter. Plug the adapter. Look on your router IP connections table. If you are lucky, it will be obvious from the name. If not, try disconnecting other things until. On the supplied remote control, press the HELP button. · The next steps may vary depending on your TV menu options: Select Status & Diagnostics → Network status. You can run a program such as the open-source and free Angry IP Scanner (there are Windows, Linux and Mac versions) which will report on all. Select your PlayStation console model to view the location of the LAN ports for each series. PS5 console model. PS5 console (CFI series). Streaming Devices · Make sure that the Blu-ray Disc player and TV or display device are turned on · Using the supplied remote, press Home. · Use the left arrow or. Select your PlayStation console model to view the location of the LAN ports for each series. PS5 console model. PS5 console (CFI series). If you're an Xfinity TV customer without X1 If you're still having issues (XR16 Voice Remote for Flex without number buttons), perform a factory reset. M posts. Discover videos related to How to Connect Wifi to Sony Tv without Remote on TikTok. See more videos about How to Turn Sony Tv on without Remote. Wireless Connection · Press the Home button on your Sony remote, then scroll to Settings. · Select Network and then Network Setup. Set the Simple IP Control option to On, enabling the TV to be turned through IP control. To set the Sony Android TV's static IP address: 1. Access the Sony TV's. The IP Remote App is a simple remote control app running on iOS™ and Android platforms. This application is available as a free download from Google Play™ and. You can invoke the auth by executing the following code, first open a tab in your browser and enter the ip address of your TV, so that. Customer: Lost remote to my Roku stick and app doesn't see my network Asks for my Roku UP address which I do not know. Technician's Assistant: What does your TV. If you're an Xfinity TV customer without X1 If you're still having issues (XR16 Voice Remote for Flex without number buttons), perform a factory reset. What Do DNS Servers Do? The servers that route your internet requests don't understand domain names like newartmart.online They only understand numeric IP addresses. Select your Harmony remote, followed by DEVICES > ADD DEVICE. Enter manufacturer Sony and model number for the smart TV you're adding. Finally, select the sync. The easiest way to find the IP camera address is to check the Network page on the CCTV camera software (mobile app or PC client).

How Much Car Rental Insurance

Damage to the car (physical damage coverage); · Injuries to others or damage to other people's property (liability coverage); and, · The rental-car company's loss. Supplemental Liability Insurance (SLI): Most states in the US do not require SLI as rental car insurance and so the car rental prices reflect that. However. Insurance is available to cover against the full amount of damage to vehicles rented by the insured for a period of 30 days or less. Car rental and travel expenses coverage is a type of insurance that provides reimbursement for rental cars and travel expenses incurred after an accident. This waiver covers only the car you're renting. If anything happens to your rental car such as fire, theft, or accident, this type of coverage helps cover these. Yes, car insurance will pay for a rental car if your policy includes rental reimbursement coverage and your car repair is part of a valid claim. This coverage. Rental car insurance costs $61 per day, on average, but it depends on how much coverage you purchase and where you're renting the car. Your personal car. Liability coverage protects you if your rental vehicle is in an accident that causes bodily harm to other individuals or damage to property. Your liability. Do you need insurance to rent a car? Opting into full-coverage insurance through the rental car company can easily cost an additional $40 per day or more. Damage to the car (physical damage coverage); · Injuries to others or damage to other people's property (liability coverage); and, · The rental-car company's loss. Supplemental Liability Insurance (SLI): Most states in the US do not require SLI as rental car insurance and so the car rental prices reflect that. However. Insurance is available to cover against the full amount of damage to vehicles rented by the insured for a period of 30 days or less. Car rental and travel expenses coverage is a type of insurance that provides reimbursement for rental cars and travel expenses incurred after an accident. This waiver covers only the car you're renting. If anything happens to your rental car such as fire, theft, or accident, this type of coverage helps cover these. Yes, car insurance will pay for a rental car if your policy includes rental reimbursement coverage and your car repair is part of a valid claim. This coverage. Rental car insurance costs $61 per day, on average, but it depends on how much coverage you purchase and where you're renting the car. Your personal car. Liability coverage protects you if your rental vehicle is in an accident that causes bodily harm to other individuals or damage to property. Your liability. Do you need insurance to rent a car? Opting into full-coverage insurance through the rental car company can easily cost an additional $40 per day or more.

However, there's one type of insurance you should get: a collision damage waiver, which covers costs associated with rental car damage or theft. It's smart to. What does a Travel Guard rental car insurance plan cover? · Up to $35,/$50, in rental car primary physical damage coverage for covered losses ($ Given that the rental car company's liability waiver coverage can cost up to $30 per day while the SEF27 rider can cost as little as $20 per year this coverage. Additionally, your premiums may increase. Your policy could even be canceled following damage or theft to your rental car. Many Hertz customers aren't aware. Supplemental Liability Insurance protects you and all authorized drivers against third-party injury and property-damage claims, available for around $15 a day. To learn more, check out these details of rental vehicle coverage. Car Insurance faqs · How much should I pay for car insurance per month? You're going to. On average, car rental insurance cost is $50 a month or $ a year for a $1 million general liability coverage. The price you pay for your commercial car. Don't overpay for insurance at the car rental counter. Here's a smarter way to protect your rental car in the US and overseas, for just $11 per calendar. Rental car insurance is a package of insurance products that protects you from financial risks that might occur if you are involved in an accident while. Our insurance has rental coverage and it is $30/Day upto $ maximum. They partnered with Enterprise car rental. Price of Rental Car Insurance You can expect to pay around $30 to $50 per day extra, on average, if you decide to add on CDW/LDW and other coverages. We. How much does rental car insurance cost? Prices vary, but full coverage typically ranges from about $20 to $50 per day. If you choose to shop a la carte. The cost of PEC varies based on the location you are renting. It will average between $ and $ per day. Supplemental Liability Protection (SLP). What is rental car insurance? · Liability: Covers you for damages or injuries you cause while driving the rental. · Loss/collision damage waiver: A loss-damage. This coverage can cost as much as $30 per day, or 25% to 40% of the base rental price. Some states have limited the amount a car rental company can charge, but. Rental car insurance can cost up to $+ a week. Make the person who you give the keys inspect the car while you're there. Simple. Rental car insurance is actually not a car insurance policy at all. Car rental companies offer a collision damage waiver (CDW), sometimes known as a “loss. Liability Insurance – By law, rental companies must provide the state required minimum amount of liability insurance coverage—often this does not provide enough. Liability protection is likely more expensive for rental cars than for your own car; it runs about $8 to $25 per day. Some countries may actually require that. Personal Auto Insurance Coverage. The coverage that you have for your own car generally applies to rental cars, as long as you aren't using the car for business.

Benefits Of Avcs

Contributions to an AVC account receive the same net investment returns as the Fund. AVCs returned % in All members can transfer money from other. AVCs can be used in a number of different ways at retirement; can be used to provide extra Scheme pension and/or a tax free lump sum (in some cases, up to the. Ask the Experts: The benefits of investing in an AVC · You save money on tax · You can top up your retirement fund with an AVC · You can take early retirement. Standard AVCs provide employees with a valuable opportunity to save for retirement while enjoying Income Tax savings. Although AVCs do not offer the National. Like your main pension, AVCs are a tax-efficient way to save because they are taken from your pay before tax. AVCs are invested with the aim of making your. Did you pay Additional Voluntary Contributions (AVCS) or do you have money purchase benefits? The Trustee needs to give you some information about these. Just some of the benefits of investing in an AVC include: · You get tax relief · You have the option to retire early · You decide how much you invest · You choose. What exactly is an AVC Pension? An AVC (Additional Voluntary Contribution) is a tax-efficient way to top up your pension. When you retire, you can use the money. Regular AVCs are taken from your pay before tax, so the money you'd normally pay as income tax automatically goes into your AVC pot instead. Contributions to an AVC account receive the same net investment returns as the Fund. AVCs returned % in All members can transfer money from other. AVCs can be used in a number of different ways at retirement; can be used to provide extra Scheme pension and/or a tax free lump sum (in some cases, up to the. Ask the Experts: The benefits of investing in an AVC · You save money on tax · You can top up your retirement fund with an AVC · You can take early retirement. Standard AVCs provide employees with a valuable opportunity to save for retirement while enjoying Income Tax savings. Although AVCs do not offer the National. Like your main pension, AVCs are a tax-efficient way to save because they are taken from your pay before tax. AVCs are invested with the aim of making your. Did you pay Additional Voluntary Contributions (AVCS) or do you have money purchase benefits? The Trustee needs to give you some information about these. Just some of the benefits of investing in an AVC include: · You get tax relief · You have the option to retire early · You decide how much you invest · You choose. What exactly is an AVC Pension? An AVC (Additional Voluntary Contribution) is a tax-efficient way to top up your pension. When you retire, you can use the money. Regular AVCs are taken from your pay before tax, so the money you'd normally pay as income tax automatically goes into your AVC pot instead.

Benefits of an AVC. What makes an AVC different to other forms of savings is that because it is designed to save towards retirement, AVCs enjoy various tax. You can do this as long as your total lump sums from the LGPS are not more than: 25% of the total value of your LGPS benefits, including the AVC plan; £, If you are looking to increase your income in retirement, one way is to pay Additional Voluntary Contributions (AVCs); the Fund offers this facility through. What are AVCs and how do they work? Under the Plan you can payAVCs to build up extra retirement benefits in a tax-efficient way. However, unlike your main. AVC stands for Additional Voluntary Contributions. These contributions allow you to build up a separate pot of money that isn't part of your main LGPS pension. WHAT TYPE OF PENSION ARRANGEMENT ARE AVCs? For clarity, the LGPS is a defined benefit. (DB) pension scheme with an in-house AVC arrangement provided. What are the advantages of an AVC pension? · They can assist you in accumulating additional retirement benefits. · When compared to the costs of setting up a. Benefits · AVCs allow you to build up a separate pot of money alongside your Local Government Pension Scheme (LGPS). · The contributions you make are tax. The benefits of making AVCs are numerous and can vary depending on your pension scheme and personal circumstances. From tax relief to compound interest, let's. The Cambridge University Assistants'. Defined Contribution Pension Scheme (CUADCPS) allows you to pay Additional Voluntary Contributions. (AVCs) to do just that. Additional Voluntary Contributions (AVCs) are a simple and tax-efficient way for pension scheme members to save for their retirement. ; Under 30, 15% ; , 20%. Your AVC plan becomes payable when you take your main LGPS benefits. All local government pension funds have an arrangement with an AVC provider (often an. Normally the retirement benefits which are payable under the rules of your main company pension plan are lower than the maximum benefits which are permitted by. You can choose to increase your benefits from the NGE Group of the ESPS by paying Additional Voluntary Contributions (AVCs). The main benefits of AVCs are: · You can top you your employer's retirement benefits as your own expense and have the benefit of income and tax relief, subject. Features of AVCs · There may be lower administration charges compared to investing into a separate Personal Pension scheme. · Flexibility - you can stop or vary. Additional Voluntary Contributions (AVCs) are personal contributions that were previously made to the Plan by some members. If you stopped paying into your LGPS pension before 1 April , you don't have to take your AVC fund at the same time as your LGPS pension benefits. You can. AVCs are a defined contribution type of pension arrangement used to build up additional pension benefits. When you pay Additional Voluntary Contributions (AVCs), you build up a pot of money which is used to provide benefits on top of your LGPS benefits. AVCs are.

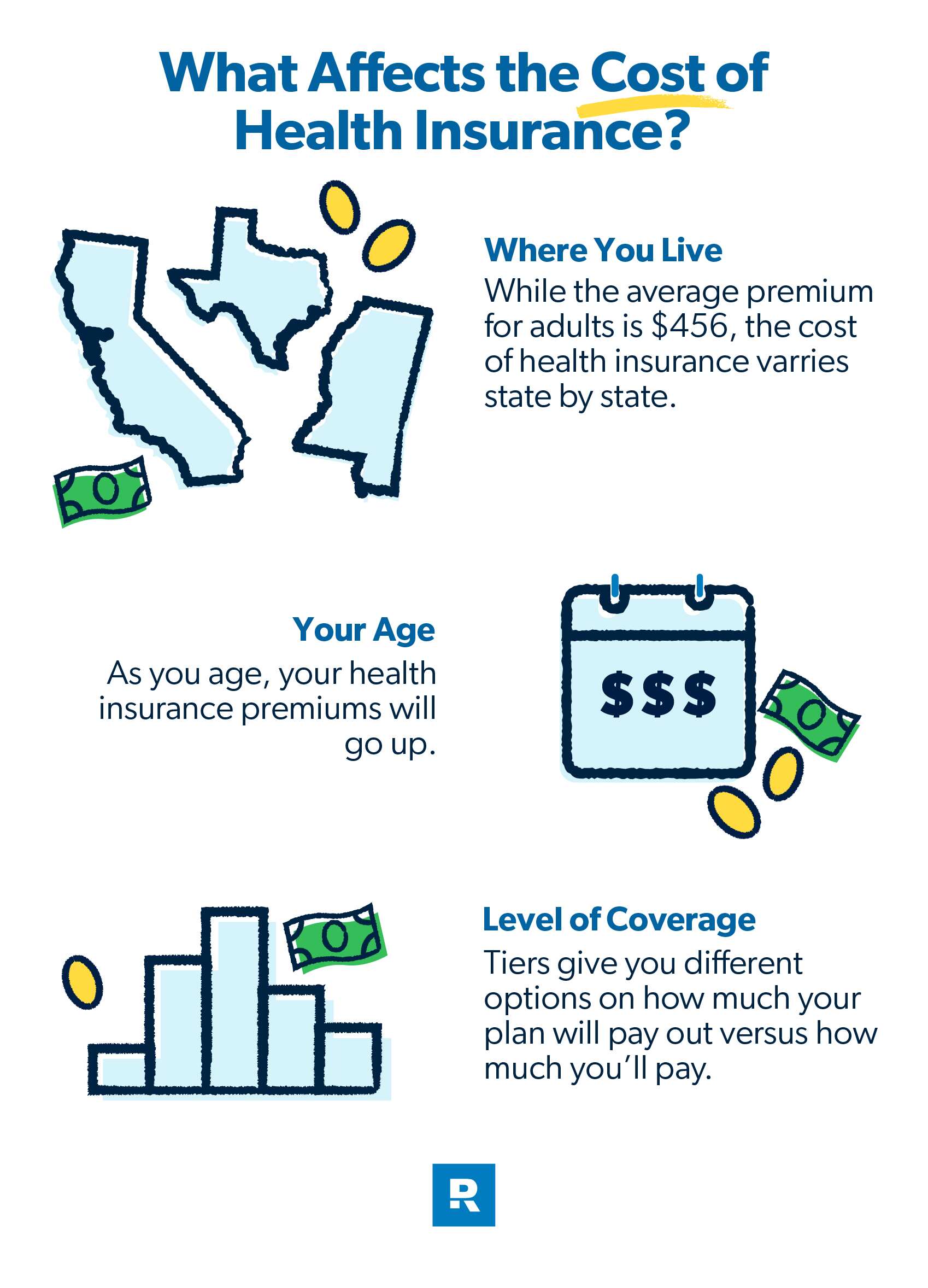

How Much Should I Pay For Medical Insurance

Curious as to how much you pay for health insurance? ; Unknown, $13/week, Unknown ; Aetna/Blue Shield, Unknown, $ ; Kaiser, $, Unknown. How much does health insurance cost? Learn about deductibles, premiums, copays and other health insurance costs in this informative article from Medical. Marketplace plans cover between 60% and 90% of your covered expenses after you've met your deductible. Example: If your plan has a $1, deductible, you pay. Finding the best plan for your budget means understanding how health insurance costs play a role in the coverage you receive. Health insurance agents must also be licensed with DIFS. These individuals cannot charge you for their assistance. Surprise Medical Billing · Prior. The average monthly health insurance cost for a year-old's individual plan is $/month; Virginia typically has the lowest individual. If you were to pay the entire amount without thru an employer or subsidies it would be on average a month for single and about 3x that. Part A (Hospital Insurance) costs · Days $0 after you pay your Part A deductible. · Days $ each day. · Days $ each day while using your. You can usually choose to pay your health insurance either monthly or annually; it's up to you. So which is better? Curious as to how much you pay for health insurance? ; Unknown, $13/week, Unknown ; Aetna/Blue Shield, Unknown, $ ; Kaiser, $, Unknown. How much does health insurance cost? Learn about deductibles, premiums, copays and other health insurance costs in this informative article from Medical. Marketplace plans cover between 60% and 90% of your covered expenses after you've met your deductible. Example: If your plan has a $1, deductible, you pay. Finding the best plan for your budget means understanding how health insurance costs play a role in the coverage you receive. Health insurance agents must also be licensed with DIFS. These individuals cannot charge you for their assistance. Surprise Medical Billing · Prior. The average monthly health insurance cost for a year-old's individual plan is $/month; Virginia typically has the lowest individual. If you were to pay the entire amount without thru an employer or subsidies it would be on average a month for single and about 3x that. Part A (Hospital Insurance) costs · Days $0 after you pay your Part A deductible. · Days $ each day. · Days $ each day while using your. You can usually choose to pay your health insurance either monthly or annually; it's up to you. So which is better?

How Much Does Health Care Cost? Depending on the health care you need and the treatment you have, your costs could be high. In general, the more services you. Nonetheless, the point estimate of $35 billion is simply the approximate midpoint of a range of values that could be used with equal confidence. Go to: WHO. How do copayments and coinsurance work? After you've met your deductible — depending on the type of plan you have — you may pay a coinsurance for some. Part A (Hospital Insurance) costs · Days $0 after you pay your Part A deductible. · Days $ each day. · Days $ each day while using your. The average annual cost of health insurance in the USA is US$7, for an individual and US$22, for a family as of , according to the Kaiser Family. Wondering how much does health insurance cost? Arkansas Blue Cross Blue Shield will help you estimate your health insurance coverage plan. Every health plan is assigned a metallic category: Bronze, Silver, or Gold. The categories can help you compare your plan options based on how much you will pay. the hospital, call your insurance company right away. Your insurance company's website. Your ID Number. How much you pay up front: PCP: $25 in-network; $ For example, if the provider's charge is $ and the allowed amount is $, the provider may bill you for the remaining $ This happens most often when you. Two things determine how much you will pay for a year of healthcare Think of this as your monthly bill – the amount you must pay your insurance company on-. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. The average annual premium for a group insurance plan normally ranges between $1, and $4, per employee. Typically, the premium payments are shared between. The EOC is your guide to what is covered and what is excluded, how much you will pay depending on the circumstances, what your cost sharing will be, and other. Looking at these health plan costs on a per member per month (PMPM) basis, they come out to $ for single coverage and $1, for family coverage, of. Of that amount, the average worker paid $/month and the average employer paid $/month. For family coverage, the total average premium was $1,/month. In , the average premium for non-subsidized health insurance for a family of four was $1, per month.* Family insurance plan costs can vary based on the. California law says that many health insurance policies must cover essential health benefits Deductible: This is the amount you must pay each year before your. Due to all these factors, the cost of health coverage in America can vary significantly. An international health insurance plan will cost more than a travel. For example, if the provider's charge is $ and the allowed amount is $, the provider may bill you for the remaining $ This happens most often when you. How Much Does Health Care Cost? Depending on the health care you need and the treatment you have, your costs could be high. In general, the more services you.

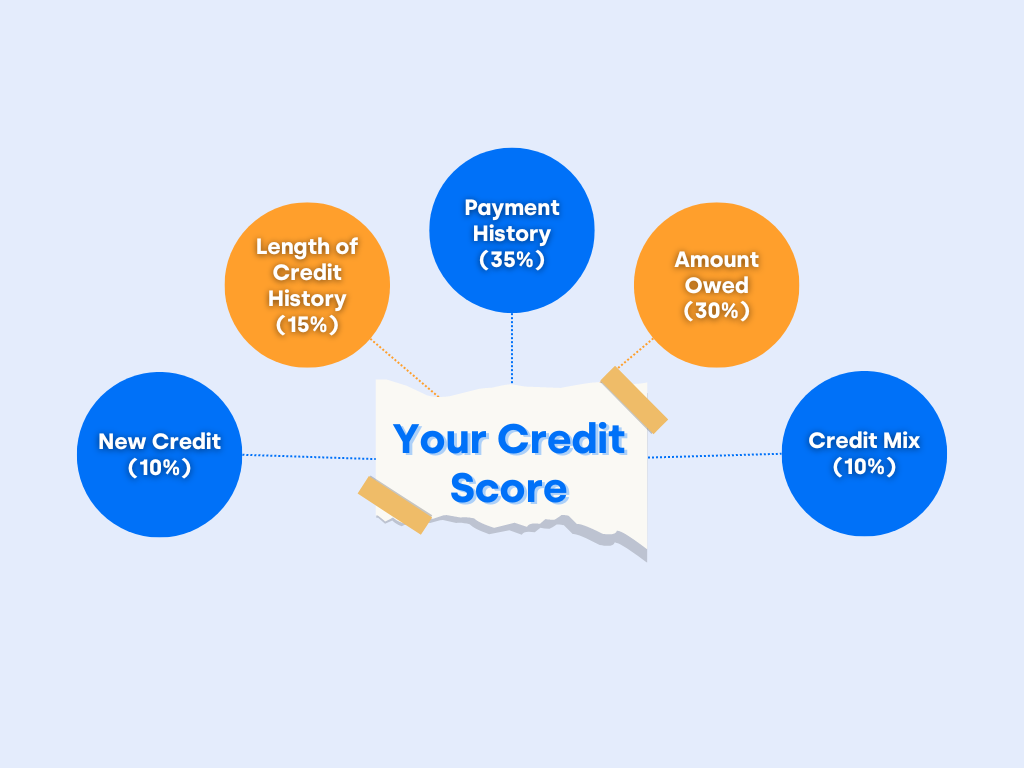

Easy Ways To Get Credit Score Up

1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. Compare your credit options · Compare your credit options · Use eligibility checkers before applying · Use eligibility checkers before applying · Double check your. Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit. One of the best ways that you can improve your credit score is by paying your bills on time. In fact, payment history is one of the primary. 1. Check your credit report · 2. Dispute any errors · 3. Pay down the balance · 4. Set up payment reminders · 5. Improve your credit utilization · FHA Loans. Minimum. 10 Ways to Improve Your Credit Score · 1. Pay your bills when they're due. · 2. Keep credit card balances low. · 3. Check for errors. · 4. Make a plan to pay down. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How to improve your credit scores: 7 tips that can help · What's a good credit score? There's no single answer to what a good credit score is. · 1. Review credit. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. Compare your credit options · Compare your credit options · Use eligibility checkers before applying · Use eligibility checkers before applying · Double check your. Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit. One of the best ways that you can improve your credit score is by paying your bills on time. In fact, payment history is one of the primary. 1. Check your credit report · 2. Dispute any errors · 3. Pay down the balance · 4. Set up payment reminders · 5. Improve your credit utilization · FHA Loans. Minimum. 10 Ways to Improve Your Credit Score · 1. Pay your bills when they're due. · 2. Keep credit card balances low. · 3. Check for errors. · 4. Make a plan to pay down. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How to improve your credit scores: 7 tips that can help · What's a good credit score? There's no single answer to what a good credit score is. · 1. Review credit. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on.

Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. A common misconception is that you need to make large purchases and immediately pay them off to increase your credit score. With a credit card, for example. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid. Here are five tips to help make sure you're improving your score — whether you're just getting started or have had credit for a few years. Check your credit report. Get a free credit report from each of the three credit reporting agencies (Equifax, Experian and TransUnion) once a year at. Pay your bills on time: Late payments can have a negative impact on your credit score, so make sure to pay your bills on time. Keep your credit. One of the best ways to build credit is to check your credit score. This Some even give tips and advice on why a score went up or down. If you are. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. Pay down your credit cards, starting with the one with the highest interest rate. If you absolutely must buy a car, get a 10 year old Corolla or something like. Reducing your balances is the most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments. Plus, the presence of the loan or HELOC on your credit report could improve your mix of credit, which accounts for 10% of a FICO score. It's a good idea to. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Experian Boost is free to use, and makes it easy to connect accounts. All you have to do is sign up and link the credit card or bank account from which you pay. Pay your bills on time · Reduce your credit utilization ratio · Use your cards · Work to pay down outstanding debt · Look for errors on your bill and credit history. How Long Does It Take to Improve Your Credit Score? There's no hard-and-fast rule that states when you can expect to see credit score improvements. But if you. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New.

Lending Institutions Examples

Financial Services Institutions · Commercial Banks (Banking) · Investment Banks (Wealth management) · Insurance Companies (Insurance) · Brokerage Firms (Advisory). Other Financial Institutions means the financial institutions except deposit money banks, specific deposit institutions, and the central bank. It mainly. The most common types of financial institutions include banks, credit unions, insurance companies, and investment companies. These entities offer various. What does the CDFI Fund Do? The Community Development Financial Institutions Fund (CDFI Fund) plays an important role in generating economic growth and. The BSA defines the term "financial institution" to include, in part, a loan or finance company. The term, however, can reasonably be construed to extend to any. Authorised Deposit-taking Institutions (ADIs) · Non-ADI Financial Institutions · Insurers and Funds Managers. Savings banks, savings and loan associations, and credit unions are examples of thrift institutions. Uninsured Agency of a FBO (Federal and State). An. Savings and loan associations and savings banks specialize in real estate lending, particularly loans for single-family homes and other residential properties. National Banks & Federal Branches and Agencies active as of 8/31/ · Trust Banks active as of 8/31/ · Federal Savings Associations active as of 8/31/ Financial Services Institutions · Commercial Banks (Banking) · Investment Banks (Wealth management) · Insurance Companies (Insurance) · Brokerage Firms (Advisory). Other Financial Institutions means the financial institutions except deposit money banks, specific deposit institutions, and the central bank. It mainly. The most common types of financial institutions include banks, credit unions, insurance companies, and investment companies. These entities offer various. What does the CDFI Fund Do? The Community Development Financial Institutions Fund (CDFI Fund) plays an important role in generating economic growth and. The BSA defines the term "financial institution" to include, in part, a loan or finance company. The term, however, can reasonably be construed to extend to any. Authorised Deposit-taking Institutions (ADIs) · Non-ADI Financial Institutions · Insurers and Funds Managers. Savings banks, savings and loan associations, and credit unions are examples of thrift institutions. Uninsured Agency of a FBO (Federal and State). An. Savings and loan associations and savings banks specialize in real estate lending, particularly loans for single-family homes and other residential properties. National Banks & Federal Branches and Agencies active as of 8/31/ · Trust Banks active as of 8/31/ · Federal Savings Associations active as of 8/31/

A lender is defined as a business or financial institution that extends credit to companies and individuals, with the expectation that the full amount of the. IFIs provide developmental lending, business financing and support services to First Nations, Métis, and Inuit businesses in all provinces and territories. OFIs are financial institutions that are not MFIs, investment funds, insurance corporations or pension funds. This definition covers a residual set of. Financial Institution Letters · Conferences & Events · Board Matters institutions because they are not included in the statutory definition. MDI. 1. Insurance Companies · 2. Credit Unions · 3. Mortgage Companies · 4. Investment Banks · 5. Brokerage Firms · 6. Central Banks · 7. Internet Banks in the UK · 8. Global Lending Agencies · International Bank for Reconstruction and Development (IBRD) · International Development Association (IDA) · International Finance. 1. Examples. Section (a) defines a financial institution as any partnership, company, corporation, association (incorporated or unincorporated), trust. NBFIs are a source of consumer credit (along with licensed banks). Examples of nonbank financial institutions include insurance firms, venture capitalists. Monetary financial institutions (MFIs) · central banks (S), i.e. the national central banks of the EU Member States and the European Central Bank; · deposit-. Unlike development banks, the IMF does not lend for specific projects. Instead, the IMF provides financial support to countries hit by crises to create. Financial institutions are organizations that process monetary transactions, including business and private loans, customer deposits, and investments. They're. Four types of institutions are included in the definition of a CDFI: CD banks, CD credit unions, CD loan funds (most of which are nonprofit), and CD venture. Community development financial institutions (CDFIs) are lenders with a mission to provide financing and support to underserved communities. Financial institutions act as an intermediary between primary savings and borrowing sectors. Financial institutions have to face challenges to gain a. A financial institution that engages in various financial services, such as accepting deposits and making loans. Includes the following Institution Types. Define Lending institution. Any insurance company, federally insured commercial or savings bank, national banking association, savings and loan association. Banks make profits by the spread between the interest rate on the loan that they make and on the deposits that they take. For example, you might have the choice. a financial institution that makes loans. Multilateral Development Banks · World Bank · European Investment Bank (EIB) · Islamic Development Bank (IsDB) · Asian Development Bank (ADB) · European Bank for. Overview of financial institutions ; Close Brothers Group plc, United Kingdom, Europe ; Co-operators Group Ltd. Canada, North America ; Coast Capital Savings.

Number 1 Car Insurance Company

Auto insurance customers have access to a number of discounts, including for bundling, insuring multiple vehicles, living on a military base, and more. A.M. GAINSCO Auto Insurance® specializes in minimum-limits personal auto insurance policies that are customizable to your needs. Call us and get a free quote! 1. State Farm · 2. Progressive · 3. GEICO · 4. Allstate · 5. USAA · 6. Liberty Mutual · 7. Farmers · 8. Travelers. Esurance Insurance Company and its affiliates: San Francisco, CA. Esurance is an Allstate company. Qualified drivers are also encouraged to get an auto. Alfa Insurance® Named #1 Auto Insurer for Customer Satisfaction in the Southeast Region by J.D. Power Alfa Insurance receives the highest score in the. 17 votes, 58 comments. Most big insurance companies give quotes online for car insurance. But most of them seem to bail out to calling a. State Farm is the nation's largest car insurance company. It also has the cheapest rates for most drivers. Progressive, Geico and Allstate are next-largest. American Family Insurance Group. American Family Connect Property and Casualty Insurance Company; Midvale Indemnity Company (not accepting any new business). Phone Numbers and Websites ; Allmerica Financial Alliance Insurance Co.*, , newartmart.online ; Allstate Fire and Casualty Insurance Co. Auto insurance customers have access to a number of discounts, including for bundling, insuring multiple vehicles, living on a military base, and more. A.M. GAINSCO Auto Insurance® specializes in minimum-limits personal auto insurance policies that are customizable to your needs. Call us and get a free quote! 1. State Farm · 2. Progressive · 3. GEICO · 4. Allstate · 5. USAA · 6. Liberty Mutual · 7. Farmers · 8. Travelers. Esurance Insurance Company and its affiliates: San Francisco, CA. Esurance is an Allstate company. Qualified drivers are also encouraged to get an auto. Alfa Insurance® Named #1 Auto Insurer for Customer Satisfaction in the Southeast Region by J.D. Power Alfa Insurance receives the highest score in the. 17 votes, 58 comments. Most big insurance companies give quotes online for car insurance. But most of them seem to bail out to calling a. State Farm is the nation's largest car insurance company. It also has the cheapest rates for most drivers. Progressive, Geico and Allstate are next-largest. American Family Insurance Group. American Family Connect Property and Casualty Insurance Company; Midvale Indemnity Company (not accepting any new business). Phone Numbers and Websites ; Allmerica Financial Alliance Insurance Co.*, , newartmart.online ; Allstate Fire and Casualty Insurance Co.

Best car insurance companies in New York · Geico · Progressive · State Farm · USAA · Allstate.

The cheapest car insurance companies in Baltimore. 1st place medal. 1st place: Travelers. Travelers is the cheapest at $ per. As a leading insurance carrier in the Garden State, NJM takes pride in its commitment to customers. NJM's customer service has been recognized both regionally. Allstate auto insurance is designed to fit your needs both on and off the road. Keep you, your loved ones and your vehicle protected with policies that include. Find out everything you need to know about having California car insurance and get a quick, low CA auto insurance quote at no cost. Best car insurance companies · Best for availability: Geico · Best for customer satisfaction: Erie · Best for pay-per-mile coverage: Nationwide · Best for liability. Arbella Insurance has been part of New England since , so we're uniquely qualified to provide you with your auto, home, and business insurance needs. Car insurance quotes to fit any budget. State Farm® offers many coverage State Farm (including State Farm Mutual Automobile Insurance Company and. Shop The General® car insurance and get a free quote today. Explore our auto insurance options to find the coverage you need at affordable rates. Home, life and car insurance from Farmers Insurance. With car insurance discounts and fast claim service, it's no wonder over customers a day switch to. AAA is one of the country's largest and most reputable car insurance companies. When you get a quote with AAA, you can be sure you're getting quality coverage. car insurance prices, Compare car insurance costs, Car insurance complaints. Link to CDI's two suspected insurance fraud reporting systems – 1) Insurance. Keep Driving with Affordable Car Insurance in 3 Simple Steps. Number 1 icon. Get a Car Insurance Quote. Online, by phone, and in-store, we offer low rates. Equity Insurance Company, () , newartmart.online ; Everest National Insurance Company, () , newartmart.online ; Explorer Insurance. AAA is one of the country's largest and most reputable car insurance companies. When you get a quote with AAA, you can be sure you're getting quality coverage. Get an online insurance quote for quality coverage in the blink of an eye. Allstate offers insurance for your car, home, rental, motorcycle and more. Why choose Liberty Mutual for car insurance? Rated "A" (Excellent) financial by A.M. Best Company, we've been helping people like you protect what they love. Get a customized insurance quote from one of the nation's largest insurance companies for auto, home, renters, and more and only pay for what you need. A survey showed that our members saved an average of $ per year when they switched to USAA Auto newartmart.online note6. Claims Made Easier. The USAA Mobile App. Allstate is the most expensive insurer, according to our data, with an average annual rate of $2, or about $ per month. North Carolinians saw insurance. 1, State Farm Group, 92,,, 2, Berkshire Hathaway Ins, 77,,, 3 Auto-Owners Ins Group, 12,,, 16, Tokio Marine US PC Group.

Invest In Insurance Policies

Investments, real estate, business interests and other investment assets can vary in value over time. A life insurance policy provides predictability. Life. The two main components that make up a life insurance policy are the death benefit and the cash value. The death benefit is the part of the plan that the. Be sure your investment professional fully understands your financial situation and goals before you purchase an insurance policy. And don't forget to consider. Have coverage that lasts your whole life2 and gives you more flexibility now and down the road—letting you change your payment amount (premiums) and schedule4. There may be limitations on how the cash value can be invested within a life insurance policy and the specific investment choices available may depend on the. There are distinct investment-insurance plans, such as the Unit Linked Insurance Plan (ULIP) for the clients, offering dual benefits. One portion of the premium. Learn what kinds of insurance policies or other investment products can meet your needs. Consider whether you can afford the policy. The fees and expenses. Term plans may be "convertible" to a permanent plan of insurance. The coverage can be "level" providing the same benefit until the policy expires or you can. Whether life insurance is a good investment for you depends on your finances, as well as the duration of coverage needed. · Term life insurance can make sense if. Investments, real estate, business interests and other investment assets can vary in value over time. A life insurance policy provides predictability. Life. The two main components that make up a life insurance policy are the death benefit and the cash value. The death benefit is the part of the plan that the. Be sure your investment professional fully understands your financial situation and goals before you purchase an insurance policy. And don't forget to consider. Have coverage that lasts your whole life2 and gives you more flexibility now and down the road—letting you change your payment amount (premiums) and schedule4. There may be limitations on how the cash value can be invested within a life insurance policy and the specific investment choices available may depend on the. There are distinct investment-insurance plans, such as the Unit Linked Insurance Plan (ULIP) for the clients, offering dual benefits. One portion of the premium. Learn what kinds of insurance policies or other investment products can meet your needs. Consider whether you can afford the policy. The fees and expenses. Term plans may be "convertible" to a permanent plan of insurance. The coverage can be "level" providing the same benefit until the policy expires or you can. Whether life insurance is a good investment for you depends on your finances, as well as the duration of coverage needed. · Term life insurance can make sense if.

The insurer invests a portion of your premiums. The return on the investment is credited to your policy tax-deferred. Universal life insurance offers a. Investment options from insurance companies also tend to be front loaded with fees that kneecap your returns in comparison to DIY by just. What is the process for getting a whole life insurance policy? · Analyze. During your initial phone call, your financial professional will ask you questions to. One way companies make sure they can cover all the payouts is to charge higher premiums for these policies. Companies also use the underwriting process to. A permanent life insurance policy can build wealth for the future. But it's not the only type of life insurance to consider. (a) A life insurance company that, before August 28, , issued or assumed the obligations of policies or annuity contracts that were registered as provided. Contract provisions and investment options vary by state. Annuities are Guardian® is a registered trademark of The Guardian Life Insurance Company of America. It will be a little wrong to call insurance policies an investment vehicle. But yes, if we specifically talk about market linked products, Unit. There's the cost of the insurance protection itself - which, by the way, is usually more expensive than what you would pay for a regular term insurance policy. Investing in life insurance offers a dual purpose. It offers financial protection but also helps you achieve long-term financial goals. Life insurance policies. A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at a. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency. In the former case, the insured party's premium is used by the company to subscribe to specialised funds on the stocks, bonds or balanced funds markets. Investment insurance is a financial product that combines the benefits of both insurance and investment. A ULIP can be considered an investment insurance. Life insurers invest premiums that they receive from customers. They SNL Life Insurance stock index over the. to period. This loss is. (Some policies offer a low guaranteed rate over a longer period.) Other investment vehicles use market indexes as a benchmark for performance. Their goal. With some policies, some of the money you pay for premiums earns interest, which creates a fund you may be able to use while you're still alive. That's the cash. John Hancock Vitality Program rewards and discounts are available only to the person insured under the eligible life insurance policy, may vary based on the. Many policyholders also use life insurance as a tax-advantaged way to help supplement their other savings plans, investments, and retirement accounts. Many policyholders also use life insurance as a tax-advantaged way to help supplement their other savings plans, investments, and retirement accounts.